The Transaction Advisory Services Ideas

Table of ContentsTransaction Advisory Services Fundamentals ExplainedNot known Incorrect Statements About Transaction Advisory Services Some Known Questions About Transaction Advisory Services.The Transaction Advisory Services IdeasThe Single Strategy To Use For Transaction Advisory Services

This action makes sure the service looks its best to possible buyers. Getting the organization's value right is critical for a successful sale. Advisors make use of different techniques, like affordable cash flow (DCF) evaluation, comparing to similar business, and current transactions, to find out the reasonable market price. This assists establish a reasonable price and work out properly with future purchasers.Transaction advisors action in to aid by obtaining all the required information organized, answering questions from buyers, and arranging visits to the organization's area. Purchase consultants use their expertise to aid organization proprietors deal with difficult negotiations, fulfill purchaser expectations, and structure bargains that match the proprietor's goals.

Meeting lawful regulations is critical in any kind of company sale. Transaction advising solutions deal with legal professionals to produce and review agreements, contracts, and various other lawful papers. This lowers dangers and makes certain the sale adheres to the legislation. The duty of deal advisors expands beyond the sale. They aid company owner in preparing for their following steps, whether it's retired life, starting a brand-new endeavor, or managing their newly found wealth.

Purchase advisors bring a riches of experience and knowledge, making certain that every aspect of the sale is taken care of expertly. Via tactical prep work, assessment, and negotiation, TAS aids local business owner accomplish the greatest possible list price. By making sure legal and governing compliance and managing due diligence alongside various other bargain group members, purchase advisors lessen possible threats and liabilities.

10 Easy Facts About Transaction Advisory Services Shown

By contrast, Huge 4 TS groups: Deal with (e.g., when a potential buyer is conducting due diligence, or when a deal is closing and the buyer needs to integrate the business and re-value the seller's Balance Sheet). Are with fees that are not linked to the deal shutting efficiently. Gain costs per involvement somewhere in the, which is much less than what financial investment financial institutions make even on "small bargains" (yet the collection probability is also a lot greater).

, yet they'll focus much more on accounting and evaluation and less on topics like LBO modeling., and "accounting professional only" subjects like trial balances and exactly how to walk via events making use of you can look here debits and credits instead than monetary declaration modifications.

The smart Trick of Transaction Advisory Services That Nobody is Discussing

Professionals in the TS/ FDD teams may likewise speak with monitoring about whatever over, and they'll create a detailed report with their findings at the end of the process.

, and the basic shape looks like this: The entry-level role, where you do a great deal of data and financial analysis (2 years for a promo from below). The following degree up; comparable job, yet you get the more intriguing little bits (3 years for a promotion).

In particular, it's challenging to obtain advertised past the Manager degree since couple of people leave the work at that phase, and you require to begin showing evidence of your capacity to produce earnings to development. Let's begin with the hours and way of life given that those are easier to explain:. There are periodic late nights and weekend break job, but nothing like the frenzied nature of investment financial.

There are cost-of-living changes, so expect lower settlement if you're in a more affordable location outside significant financial (Transaction Advisory Services). For all placements other than Partner, the base pay makes up the bulk of the overall payment; the year-end reward could be a max of 30% of your base pay. Usually, the very best method to increase your incomes is to switch over to a different company and discuss for a greater income and perk

Transaction Advisory Services Can Be Fun For Everyone

At this phase, you should simply remain and make a run for a Partner-level he has a good point duty. If you desire to leave, possibly move to a customer and do their appraisals and due persistance in-house.

The main issue is that because: You normally require to join one more Huge 4 team, read more such as audit, and work there for a couple of years and afterwards relocate into TS, job there for a couple of years and after that move into IB. And there's still no warranty of winning this IB duty because it depends on your region, clients, and the employing market at the time.

Longer-term, there is additionally some threat of and due to the fact that reviewing a firm's historic economic info is not specifically rocket scientific research. Yes, human beings will certainly always require to be entailed, however with advanced technology, lower headcounts can possibly support client interactions. That said, the Transaction Solutions group beats audit in terms of pay, job, and leave chances.

If you liked this write-up, you could be curious about reading.

The Buzz on Transaction Advisory Services

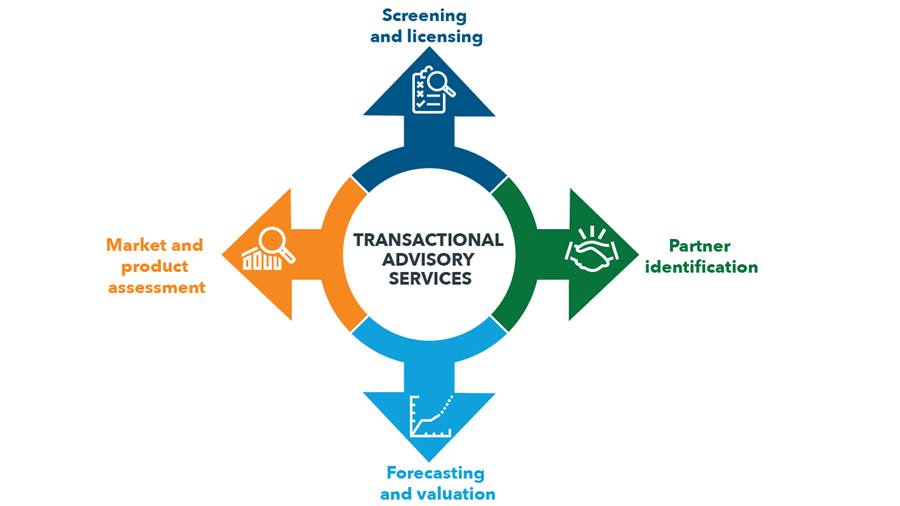

Establish innovative economic structures that aid in establishing the real market worth of a company. Give advisory operate in connection to company assessment to help in bargaining and prices structures. Describe the most ideal kind of the bargain and the kind of consideration to use (money, supply, gain out, and others).

Develop action plans for risk and direct exposure that have actually been determined. Execute integration planning to identify the procedure, system, and organizational adjustments that might be required after the deal. Make numerical quotes of integration costs and advantages to examine the economic reasoning of integration. Establish guidelines for integrating departments, modern technologies, and company procedures.

Assess the potential consumer base, market verticals, and sales cycle. The operational due persistance supplies important understandings right into the functioning of the firm to be obtained concerning risk assessment and value production.